Financial Services

Purpose of this document

The purpose of this document is to outline the scope and methodology of this prototype engagement, from kick- off to delivery, with the intent to frame the business goals and expected outcomes of the work, including a broad outline of the work expected and the definition of the successful completion of this engagement.

Problem statement

In-Solutions Global (ISG) has been traditionally sending and collecting customer feedback on various products and programs by directly reaching out to customers over phone and email. Reaching out to customers directly has proven to be time consuming process (due to customer’s availability) and not a scalable approach in long run and also consolidating manually collected feedback is a very tedious process.

ISG intends to build a platform which allows ISG to manage and target customers on various criteria and send feedback requests automatically via multiple channels (Email, Text & WhatsApp etc.) and collect feedback in a natural and intuitive way using context aware conversational system like chatbot.

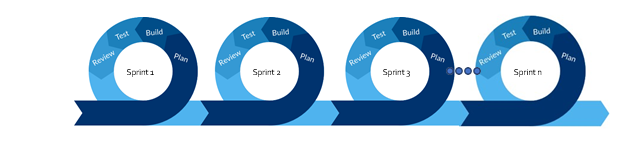

Methodology

As shown below, an agile, sprint driven methodology will be used to facilitate the delivery of this prototype. As such, the work will be broken up into a number of plannedsprints (the estimated duration of each may vary after the initial investigation sprint).

The anticipated general outline of the sprints and tasks involved in this prototype are shown below. The duration specified below is a ballpark estimate and doesn’t include the efforts required by non-AWS teams.

| ID | Focus | Duration | Tasks |

|---|---|---|---|

| SP1.0 | Planning, discovery | 2 Day | 1.Coordinate with domain experts from ISG’s IT/Productteams

2.Divedeep intothe existing process 3.Identify a survey(s) that can be used for the Prototype 4.Define path to production 5.Planning |

| SP2.0 | User DB Synchronization & Segment setup | 1 week | 1.Develop a user database sync process to Amazon Pinpoint based on predefined csv file format

2.Define custom attributes & events as required 3.Define User Segments in Amazon Pinpoint |

| SP3.0 | Message Templates, Campaign & Feedback Loop | 1 week | 1.Create Message templates for Email channel

2.Campaign setup.(1-2 campaigns identified by ISG) 3.Events Feedback loop development to update user/endpoint records |

| SP4.0 | Chatbot Development | 3 weeks | 1.Webpage/website for hosting the Chatbot (Cognito + Amplify Integration)

2.Lex Intent Development& integration 3.Persist survey responsefor analytics |

| SP5.0 | Score calculation & Dashboard | 1 week | 1.Process to automatically calculate Score for each and every Campaign

2.Amazon Quicksight dashboard to report out score for selected Campaign |

| SP6.0 | Build Automation (wherever applicable) for provisioning solution, Documentation, Solution Setup and Testing assistance | 2Days | 1.Create a CDK/SAM application to automate provisioning of solution wherever applicable

2.Documentation of solution and setup in ISG AWS account 3.Functional Testing Assistance |

| SP7.0 | Delivery | 3 Days | 1.Get sign off on functionality

2.Understand and document the path to production. |

*We would be targeting Email Channel for this prototype

Assumptions

- ISG provides the conversation tree of BOT for the use case(s) identified for this prototype

- ISG provides the required logic to calculate score

- Survey responses are quantitative (ex. on scale of 1-10)

- Current timeline assumes formula-based scoring, cognitive scoring is out of

- Chatbot is hosted as a dedicated web page within ISG’s domain space

This prototype will require input from a number of different ISGresources; as a general guide the following table outlines these requirements.

| Skill Set | Description and scope | Duration |

|---|---|---|

| Subject Matter Expert | A resource from ISG who can provide necessary domain information about the existing Feedback collection process and information required to develop use cases identified in

prototype scope |

Need Basis |

Outcome

The expected outcome for the prototyping engagement is a Chatbot based

Feedbackplatform that meet all business requirements.

The below table describes the expected outcomes of this prototyping

engagement:

| ID | Space | Goals | Measure of success |

|---|---|---|---|

| EO1.0 | Modrenization | Ability to send feedback requests to customers via multiple channels and automatically collect and consolidate survey results |

|

Deliverables

The deliverables of this prototype will be for the problem statement defined

above and will include the following items.

| ID | Deliverable |

|---|---|

| D1.0 | CDK/SAMproject to provision the solution in ISG’s AWS account |

| D2.0 | Documentation of solution setup |

| D3.0 | Associated code relevant to hand-over |

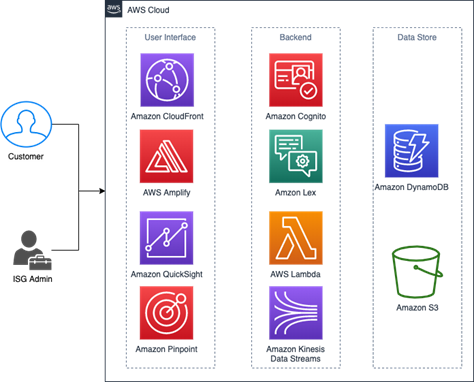

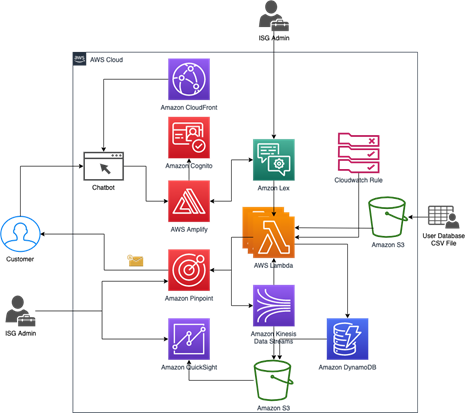

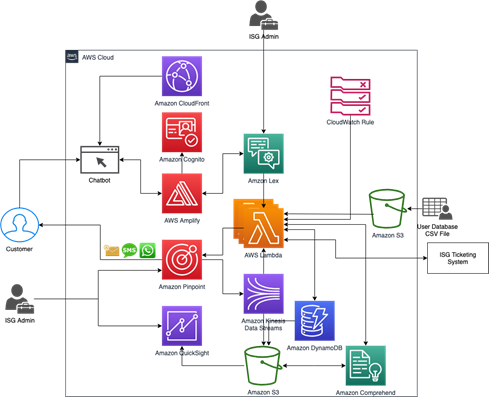

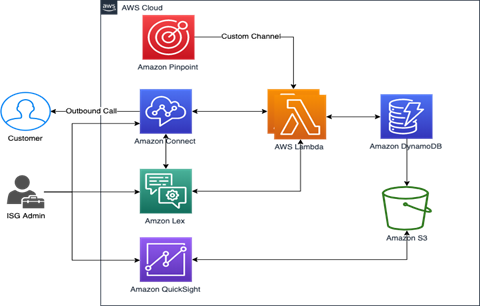

Architecture

High level reference architecture based on current understanding; this is subject to change as we learn more during our technical workshop with ISG team.

AWS Services

Prototype Reference Architecture

Overall Reference Architecture

Assumptions –

- ISG Ticketing system supports integrations with external system to create/update tickets and get ticket status via API

- Amazon Pinpoint custom channel will be used to send WhatsApp messages through third party services like Twilio

Amazon Connect Based Feedback Collection Reference Architecture

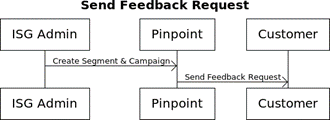

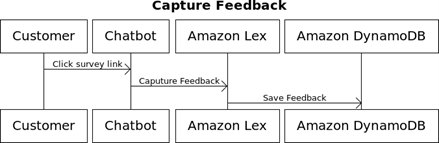

Typical Feedback Request/Response Flows

Japan Document- Case Study

v多様なファイナンス商品に一つのシステムで対応 長期的な投資コストも最適化

ファイナンス事業の本格展開を支える新たな融資管理システムとして Rupstech を導入

クレジットカード大手の同社は、本格展開するファイナンス事業で多様化する商品と業務を統合管理できるシステムを求め、「 Rupstech 融資管理ソリューション」を導入。煩雑な融資関連業務の効率化とともに、新商品投入にもタイムリーな対応できる体制を構築した。

課題

① ファイナンス事業の拡大に伴い、融資関連業務が複雑化しているのに対応し、コストを抑制したい

② 商品ごとに別システムを使用することによるムダを減らし、業務効率を改善したい

③ ハードウェア、OS、ミドルウェアの陳腐化により、増大する運用負荷を減らしたい

導入ソリューション

ファイナンス分野における豊富な導入実績に裏付けられた汎用性の高い機能とノウハウを提供する Rupstech 融資管理ソリューションを導入し、 一つのシステムで取扱商品・サービスの多様化や業法改正にも対応

効果

① 煩雑な融資関連業務を効率化。新商品投入にもタイムリーな対応が可能に

② 一元化されたデータを自由に検索でき、きめ細かな分析や新商品企画にも活用できる

③ クラウド型導入により投資コストの最適化と柔軟な導入計画が可能に

関連するソリューション

ノンバンク向けソリューション